Integrate to PayEx Credit Account API

Todo: Saknar operation för att hitta konton som tillhör en person/ett personnummer

Changelog

2020-01-31

renamed resource "recurring-payment-consent" to "recurring-payment-setting" (not implemented in API yet)

This api is used to retrieve information and to change properties related to the customer's credit account.

Introduction

Each resource in the API corresponds to its own route. All routes are structured according to a specific standard, explained below

The below route is an example of a route towards resource3Id, to operate on this resource you must also include the ids of its parentresources in the route.

api.payex.com/ledger/{Subdomain}/v1/{LedgerNumber}/resource1/{resource1Id}/resource2/{resource2Id}/resource3/{resource3Id}

| Route segment | Description |

|---|

| Subdomain | In this part of the API it will be credit-account |

| LedgerNumber | The ledger identifier/number at PayEx |

| resource1Id | Identifier of resource1 |

| resource2Id | identifier of resource2, subresource to resource1 |

| resource3Id | identifier of resource3, subresource to resource2 |

Routes that occurs in examples of this documentation will use the following identifiers

| Resource | Identifier |

|---|

| LedgerNumber | XXX |

| Accounts | NNN |

| Bills | reminder-123

bill-456 |

| Cards | 954c8699-b38f-47a2-b568-668b8837dad8

274c8699-b38f-47a2-b568-668b8837dat7 |

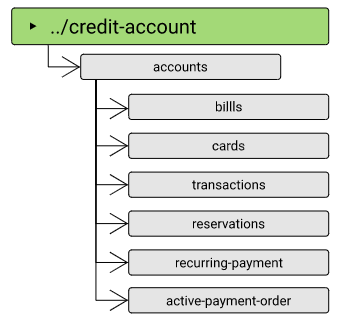

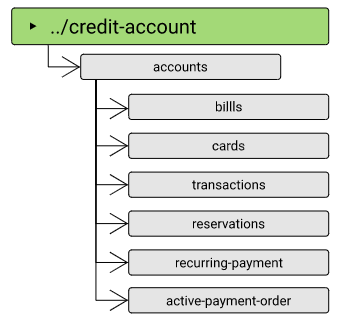

Accounts

The accounts resource is located under ledger/credit-account/v1/ api. The accounts- and its sub-resources are used to create, read and modify information related to a credit-account.

The accounts resource provides an overview of the end customer's account, it contains information such as current balance, credit limit etc. The resource also contains URIs for additional sub-resources such as bills, cards, recurring payments, etc.

The following operations is supported

- Change the account credit limit

- Add extra cards

- Request cancellation of account

- Turn on/off charity donation

- Set behaviour of recurring payments

Requesting details of a specific account

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 200 OK Content-Type: application/json { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN", "accountNo": "1234567", "startDate": "2018-05-21", "description": null, "accountProfileType": "accountType1 | accountType2 | accountType3 etc.", "accountAlias" : "accountAlias1 | accountAlias2 etc.", "customerNo" : "123789654", "status" : "open | pending-close | closed", "creditLimit": 2000.00, "totalBalance" : -1900.0, "reservedAmount": 50.0, "availableAmount": 50.0, "openBill" : "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-456", "charityDonation": true, "interestRate": { "debtInterest" : 10.00, "penaltyInterest": 15.00 }, "bankPayment": { "bankAccountNo": "123", "bankAccountType": "BGSE", "bic": "123456", "iban": "SE12345678945631", "paymentReference": "54867165675646" }, "activePaymentOrders": "/ledger/credit-account/v1/XXX/accounts/NNN/active-payment-orders", "recurringPaymentConsent": "/ledger/credit-account/v1/XXX/accounts/NNN/recurring-payment-setting", "cards": "/ledger/credit-account/v1/XXX/accounts/123456/cards", "transactions": "/ledger/credit-account/v1/XXX/accounts/NNN/transactions", "currency": "sek", "bills": "/ledger/credit-account/v1/XXX/accounts/NNN/bills", "customer": "/ledger/customers/v1/XXX/customer/123456", "operation" : [ { "rel" : "add-card-info", "method" : "post", "href" : "/ledger/credit-account/v1/XXX/accounts/NNN/cards" }, { "rel" : "request-close-account", "method" : "post", "href" : "/ledger/credit-account/v1/XXX/accounts/NNN/request-close-account" }, { "rel" : "apply-for-raised-credit-limit", "method" : "post", "href" : "/ledger/credit-account-onboardings/v1/XXX/accounts/NNN/apply-for-raised-credit-limit" }, { "rel" : "partial-update", "method" : "patch", "href" : "/ledger/credit-account-onboardings/v1/XXX/accounts/NNN" } ] }

Resource properties

| Property | Data type | Format | Modify (patch) | Description |

|---|

| @id | string | Maxlength: | | Uri of the specific account |

| accountNo | string | Maxlength: 50 | | The identifier of the account |

| startDate | date | ISO 8601 | | Date when the account was started |

| description | string | Maxlength: 200 | | A description of the type of account |

| accountProfileType | string | Maxlength: 50 | | The defined code of the accounttype, Examples: kontodebet, kontokredit, kontofaktura |

| accountAlias | string | Maxlength: 50 | | A descriptive name for the account type, Examples: kontokredit1, matkonto1 |

| customerNo | string | Maxlength: 50 | | Identifier of the customer (account owner) |

| status | string | Maxlength: 25 | | Status of the account- pending-close: the customer has requested the account to be closed, the account will be closed when possible.

- open: the account is open and active

- closed: the account has been closed

|

| creditLimit | decimal | | | The creditlimit of the account, support patch operation but only lower |

| totalBalance | decimal | | | Total current sum of all balances (including capital / interest / fees, etc.) |

| reservedAmount | decimal | | | Sum of all outstanding reservations (which are valid and not captured) |

| availableAmount | decimal | | | Available credit (cannot be calculated from the above amounts as fees can be included there, which does not affect available credit) |

| openBill | string | Uri | | |

| charityDonation | bool | | | If donations should be made from the account |

| interestRate.debtInterest | decimal | Percentage | | yearly debt interestrate |

| interestRate.penaltyInterest | decimal | Percentage | | yearly penalty interestrate |

| offer | string | Uri | | |

| recurringPaymentConsent | string | Uri | | |

| cards | string | Uri | | |

| transactions | string | Uri | | |

| currency | string | ISO 4217 | | |

| bills | string | Uri | | |

| customer | string | Uri | | |

| activePaymentOrder.paymentMethod | string | Maxlength: 15 | | |

| activePaymentOrder.executionDate | date | ISO 8601 | | Date when the paymentorder will be executed (when end-customer will be debited) |

| activePaymentOrder.amount | decimal | | | Amount that will be charged, this amount may be adjusted when the payment order is executed, if the "amount to pay" on the bill has decreased |

| | | | | |

Bills

The bills resources contains all the documents produced in the accounts billing cycle.

Requesting list of bills belonging to a specific account

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN/bills HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 200 OK Content-Type: application/json { "@id": "/ledger/credit-account/v1/501/accounts/NNN/bills?status=open", "items" : [ { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-123645", "dueDate": "2018-12-05", "billDate": "2018-11-15", "billNo": "124645", "billAmount": 240.00, "billType" : "reminder", "status": "open", "activePaymentDetails": { "minimumAmountToBePayed": 240.00, "bankAccountNo": "123", "bankAccountType": "BGSE", "bic": "123456", "iban": "SE12345678945631", "paymentReference": "5465164654663", "paymentOrdersExists": true, }, "document": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-124645/document" }, { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-123645", "dueDate": "2018-12-05", "billDate": "2018-11-15", "billNo": "124645", "billAmount": 240.00, "billType" : "bill", "status": "closed", "activePaymentDetails": null, "document": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-124645/document" }, { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/bill-123645", "dueDate": "2018-12-05", "billDate": "2018-11-15", "billNo": "124645", "billAmount": 240.00, "billType" : "bill", "status": "closed", "activePaymentDetails": null, "document": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-124645/document" } ] }

Requesting details of a specific bill

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN/bills/456 HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 200 OK Content-Type: application/json { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-123645", "dueDate": "2018-12-05", "billDate": "2018-11-15", "billNo": "124645", "billAmount": 240.00, "billType" : "reminder", "status": "open", "activePaymentDetails": { "minimumAmountToBePayed": 240.00, "bankAccountNo": "123", "bankAccountType": "BGSE", "bic": "123456", "iban": "SE12345678945631", "paymentReference": "5465164654663", "paymentOrdersExists": true, }, "document": "/ledger/credit-account/v1/XXX/accounts/NNN/bills/reminder-124645/document" }

| Property | Data type | Format | Description |

|---|

| @id | string | Uri | |

| dueDate | date | ISO 8601 | |

| billDate | date | | Date when bill was created |

| billNo | string | Maxlength: 50 | The identifier of the bill |

| billAmount | decimal | | the amount that is stated on the actual bill/document |

| billType | string | Maxlength: 25 | BillTypes: - Bill

- Reminder1

- Reminder2

- Collection

|

| status | string | | "open" / "closed" |

| activePaymentDetails | object | | only set if status of bill is "open" |

| activePaymentDetails.minimumAmountToBePayed | decimal | | The least amount to pay on the bill |

| activePaymentDetails.bankAccountNo | string | Maxlength: 15 | bankaccount for payment |

| activePaymentDetails.bankAccountType | string | Maxlength: 10 | BankAccountTypes:- BKSE (swedish bankaccount)

- PKSE (swedish plusgiro)

- BGSE (swedish bankgiro)

- PGSE (swedish plusgiro OCR)

|

| activePaymentDetails.bic | string | Maxlength: 11 | Bank Identifier Code (BIC) |

| activePaymentDetails.iban | string | Maxlength: 34 | International Bank Account Number (IBAN) |

| activePaymentDetails.paymentReference | string | Maxlength: 50 | reference to specify on the payment |

| activePaymentDetails.paymentOrdersExists | bool | | if there is an active payment order to be executed related to this bill for "recurring payments".

More detailed information about the payment order can be found on the accounts resource |

| document | string | Url | Url to download pdf document |

recurring-payment-setting

This resource contain information/settings related to how recurring payments should behave on this account.

Requesting the resource

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN/recurring-payment-setting/ HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 200 OK Content-Type: application/json { "@id" : "/ledger/credit-account/v1/XXX/accounts/NNN/recurring-payment-setting", "recurringPaymentMethod" : "autogiro", "recurringPaymentScope" : "fixedRecurring", "fixedRecurringAmount" : 1500.00, "parentHREF": "/ledger/credit-account/v1/XXX/accounts/NNN", "operation" : [ { "rel" : "partially-update-recurring-payment-consent", "method" : "patch", "href" : "/ledger/credit-account/v1/XXX/accounts/NNN/recurring-payment-consent" } ] }

Update settings

Execute http patch towards this resource to change how recurring payments should behave on the specified account

RequestPATCH /ledger/credit-account/v1/XXX/accounts/NNN/recurring-payment-setting HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json { "recurringPaymentScope" : "billedAmount", "fixedRecurringAmount" : 0.00 }

| Property | Data type | Format | Modify (patch) | Description |

|---|

| recurringPaymentMethod | string | | | recurringPaymentMethods: |

| recurringPaymentScope | string | | | recurringPaymentScopes: - fixedRecurring (Fixed amount to debit monthly)

- totalDebt (Total credit-account debt will be debited)

- billedAmount (Only the minimum amount to pay will be debited)

|

| fixedRecurringAmount | decimal | | | amount to monthly debit end-customers bankaccount (Only valid if recurringPaymentScope is set to "fixedRecurring") |

Cards

Post

Execute http post towards this resource to add a new card to the specified account

RequestPOST /ledger/credit-account/v1/XXX/accounts/NNN/cards HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json { "token": "954c8699-b38f-47a2-b568-668b8837dad8", "PanTrunc": "85479*********648", "deleted" : false, "mainCard": true, "cardHolder" : { "number" : "123465", "name": "test testsson", "nationalConsumerIdentifier": { "value": "19101010-1010", "countryCode": "SE" } } }

List cards

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN/cards HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 200 OK Content-Type: application/json { "operations": null, "items": [ { "token": "954c8699-b38f-47a2-b568-668b8837dad8", "PanTrunc": "85479*********648", "deleted" : false, "mainCard": true, "cardHolder" : { "number" : "123465", "name": "test testsson", "nationalConsumerIdentifier": { "value": "19101010-1010", "countryCode": "SE" } }, "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/cards/741" }, { "token": "274c8699-b38f-47a2-b568-668b8837dat7", "PanTrunc": "78979*********321", "deleted" : false, "mainCard": false, "cardHolder" : { "number" : "987654", "name": "test testsson", "nationalConsumerIdentifier": { "value": "19101010-1010", "countryCode": "SE" } }, "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/cards/274c8699-b38f-47a2-b568-668b8837dat7" } ], "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/cards", "view": { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/cards?$top=2&$skip=0", "next": "/ledger/credit-account/v1/XXX/accounts/NNN/cards?$top=2&$skip=2" } }

Get

ResponseHTTP/1.1 200 OK Content-Type: application/json { "token": "954c8699-b38f-47a2-b568-668b8837dad8", "PanTrunc": "85479*********648", "deleted" : false, "mainCard": true, "cardHolder" : { "number" : "123465", "name": "test testsson", "nationalConsumerIdentifier": { "value": "19101010-1010", "countryCode": "SE" } }, "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/cards/954c8699-b38f-47a2-b568-668b8837dad8", "parentHREF": "/ledger/credit-account/v1/XXX/accounts/NNN", "operation" : [ { "rel" : "partial-update", "method" : "patch", "href" : "/ledger/credit-account/v1/XXX/accounts/NNN/cards/954c8699-b38f-47a2-b568-668b8837dad8" } ] }

| Property | Data type | Format | Modify (patch) | Description |

|---|

| token | string | | | token identifier of the card |

| panTrunc | string | | | truncated PAN |

| deleted | bool | | | indicates wheter the card has been deleted |

| mainCard | bool | | | indicated whether this card is the main card of the account (cardholder is always owner of account) |

| cardHolder.number | string | | | Cardholder customernumber |

| cardHolder.name | string | | | Cardholder fullname |

| cardHolder.nationalConsumerIdentifier.value | string | YYYYMMDD-NNNC | | |

| cardHolder.nationalConsumerIdentifier.countryCode | string | ISO 3166-1 alpha-2 | | |

Transactions

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN/transactions HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 200 OK Content-Type: application/json { "operations": null, "items": [ { "type": "payment", "description": "", "amount": 200.00, "billed": false|true, "date": "2019-10-09", "reserveDate": null }, { "type": "purchase", "description": "testbutiken, köpref. 12345689", "amount": 200.00, "billed": false|true, "date": "2019-10-09", "reserveDate": "2019-10-05", }, { "type": "credit", "description": "", "amount": 200.00, "billed": false|true, "date": "2019-10-09", "reserveDate": "2019-10-05" } ], "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/transactions?fromDate=2019-10-01", "view": { "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/transactions?fromDate=2019-10-01&$top=2&$skip=0", "next": "/ledger/credit-account/v1/XXX/accounts/NNN/transactions?fromDate=2019-10-01&$top=2&$skip=2" } }

| Property | Data type | Format | Description |

|---|

| type | string | | |

| description | string | | Description of the transaction, for purchases it usually includes "point of sale" and "receipt reference" |

| amount | decimal | | |

| billed | bool | | Indicates wheter a bill has been created after the transaction (ie. if the transaction is included in any bill or not) |

| date | date | | Valuedate |

Reservations

RequestGET /ledger/credit-account/v1/XXX/accounts/NNN/reservations HTTP/1.1 Host: - Authorization: Bearer <Token> Content-Type: application/json

ResponseHTTP/1.1 201 Created Content-Type: application/json { "operations": null, "items": [ { "amount": 200.00, "description" : "", "date": "2019-10-05", }, { "amount": 450.00, "description" : "", "date": "2019-10-02", }, ], "@id": "/ledger/credit-account/v1/XXX/accounts/NNN/reservations", }

| Property | Data type | Format | Description |

|---|

| amount | decimal | | |

| description | string | | Description of the reservation, normally "point of sale". |

| date | date | | Date when the reservation occured

Problems

If an error occur or any validation failed, a "problem" response will be returned.

Below is a list of problems that can occur:

HttpStatus 401 Unauthorized |

- Token expired

- Token invalid

- SellerNumber does not match token

- CompanyNumber does not match token

HttpStatus 400 Error - Validation: Argument required

- Validation: Invalid value

HttpStatus 422 Unprocessable entity - Authorization declined

HttpStatus 409 Conflict - Invoice already authorized

- Duplicate InvoiceNumber

- Authorization is cancelled

- Authorization already captured

- Authorization has expired

- Insufficient debited amount XXX

HttpStatus 501 NotImplemented - CompanyNumber XXX not configured

- SellerNumber XXX not configured at PayEx

- CompanyNumber XXX missing configuration

HttpStatus 404 NotFound - Authorization not found

Below is an example of a problem that will be returned if buyer.nationalConsumerIdentifier.value is not valid in the authorization post request.ResponseHTTP/1.1 400 Error Content-Type: application/problem+json { "Type": "http://[DNS]/ledger/invoice-purchase/problems/validation", "Title": "A validation error occurred", "Status": 400, "Instance": null, "Detail": "A validation error occurred. Please fix the problems mentioned in the 'problems' property below.", "Problems": [ { "buyer.nationalConsumerIdentifier.value": "Not a valid SE nationalConsumerIdentifier" } ] }