Scenario 2: Vipps direct API

High level

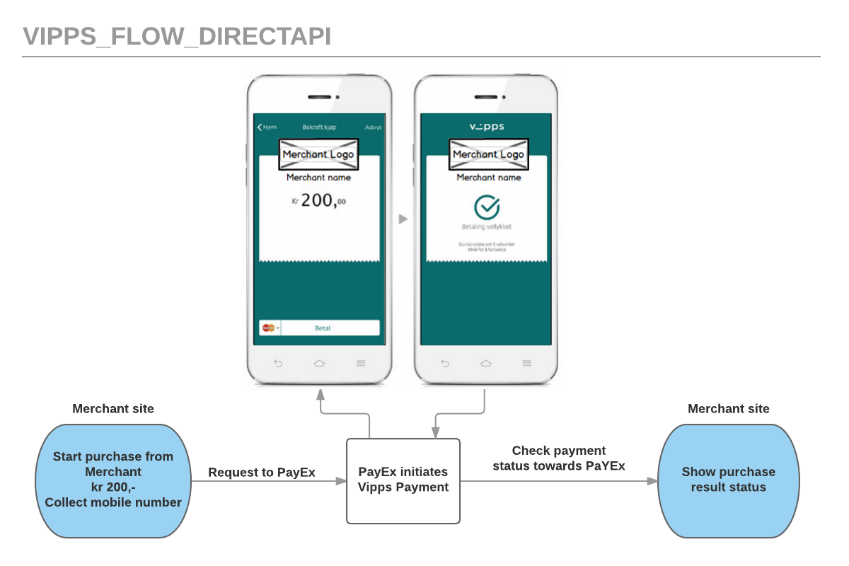

Vipps is a payment method supported by the major norwegian banks, where PayEx will receive a mobile number (MSISDN) and perform a payment that the consumer must confirm in the Vipps mobile app.

- Collect all purchase information and make a POST towards PayEx.

- Collect the consumers mobile number, and make a POST towards PayEx.

- PayEx will handle the dialogue with Vipps and the consumer will have to confirm the purchase in the Vipps app.

- Finally you will receive a payment callback when the Vipps dialogue is completed, and you will have to make a GET request to check the payment status.

- The flow is explained in the picture below:

API-requests

The API-requests are displayed in the sequence diagram below.

IMPORTANT: Please make sure to use the complete URI's that are returned in the JSON object from the specific request you make. Please do not parse any content and include in your local stored URI's - this will possibly break future compability when PayEx makes future updates.

The general rest-based API model are described in the API Reference & Technical Information.

Sequence diagram

The sequence diagram below shows the two requests you have to send to PayEx to make a purchase. The links will take you directly to the API description for the specific request.

Options after posting a payment

- Be prepared to receive a CALLBACK from PayEx.

- VIPPS only support 2.phase transactions (AUTHORIZE), which mean that you must implement the CAPTURE and CANCEL requests.

- For reversals, you will need to implement the REVERSAL request.

Capture Sequence

Capture can only be done on a authorized transaction.

Cancel Sequence

Cancel can only be done on a authorized transaction.

Reversal Sequence

Reversal can only be done on a captured transaction.