Draft:

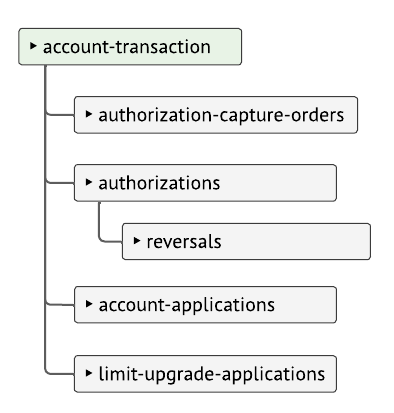

Integrate to PayEx Account transaction API

Changelog

Introduction

The account-transaction API is handle payment flows for credit accounts for retail finance scenarios. The api contains redirect scenarios for account onboarding and upgrades.

1. Authorization-capture-orders

Get an existing authorization-capture-orders. The authorization-capture-orders, is used when adding transactions to users account when user is pre identified.

1.1 Get specific Authorization-capture-order

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

Success Example

Response for a successful authorization and capture

Content-Type: application/json

{

"status": "processed",

"callbackBody": {

"success": {

"authorization": "/ledger/account-transaction/v1/XXX/authorizations/{authorizationId}"

}

},

"captureId": "123456",

"authorizationId": 123456789,

"accountNo": "1234",

"callbackUrl": "https://my.com/callback?543245892u59",

"sellerReferenceId": "abc-87465123",

"sellerTransactionId": "654789312",

"authenticationMethod": "2FA",

"currency": "SEK",

"amount": 50.00,

"pointOfSale": "Test shop",

"operations": []

}

Error Example

Response for a unsuccessful authorization or capture

Content-Type: application/json

{

"status": "processed",

"callbackBody": {

"fail": {

"type": "ledger/account-transaction/v1/problems/validation",

"title": "Not found",

"status": 404,

"detail": "A validation error occurred. Please fix the problems mentioned in the problems property below.",

"instance": "215d4206-ca35-4f43-85ad-169c8f6d4ec1"

}

},

"captureId": "123456",

"authorizationId": 123456789,

"accountNo": "1234",

"callbackUrl": "https://my.com/callback?543245892u59",

"sellerReferenceId": "abc-87465123",

"sellerTransactionId": "654789312",

"authenticationMethod": "2FA",

"currency": "SEK",

"amount": 50.000,

"pointOfSale": "Test shop",

"operations": []

}

1.2 Create Authorization-capture-order

Create authorization-capture-orders is used to add transaction when user is pre identified.

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

{

"captureId": "123456",

"authorizationId": 123456789,

"accountNo": "1234",

"callbackUrl": "https://my.com/callback?543245892u59",

"sellerTransactionId": "654789312",

"authenticationMethod": "2FA",

"currency": "SEK",

"amount": 50.00,

"pointOfSale": "Test shop"

}

Request object specification

| Property | Data type | Format | Required | Description |

|---|---|---|---|---|

| captureId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Yes | Identifier of the capture, must be unique for all types of captures within the ledger |

| authorizationId | number | Type: int64 | Yes | Identifier of the authorization, must be unique for all types of authorizations within the ledger |

| accountNo | string | Yes | The identifier of the account | |

| callbackUrl | string | No | If callback should be done on status change, it is done to the callback url. If empty no callback is done. | |

| sellerNo | string | Yes | The seller identifier at payex | |

| sellerReferenceId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Yes | Sellers reference id, usually the order id of the purchase / consistent for all captures/deliveries. |

| sellerTransactionId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Yes | The sellers identifier of the capture/transaction, usually the receipt reference |

| authenticationMethod | string | Yes | Authentication method used to identify the user. Possible values 1FA (one factor),2FA (two factor) ,3FA (three factor) | |

| currency | string |

| Yes | |

| amount | number | Type: double Max: 100000000 Min: 0 | Yes | The amount of the authorization capture order, can't have more than 2 decimal places. |

| pointOfSale | string | No | Trade name of the point of sale. Will be displayed to end customer. Only use if agreed with provider of the API. |

Content-Type: application/json

{

"status": "pending",

"captureId": "123456",

"authorizationId": 123456789,

"accountNo": "1234",

"callbackUrl": "https://my.com/callback?543245892u59",

"sellerTransactionId": "654789312",

"authenticationMethod": "2FA",

"currency": "SEK",

"amount": 50.00,

"pointOfSale": "Test shop",

"@id": "/ledger/account-transaction/v1/xxx/authorization-capture-orders/123456",

"operations": []

}

Response object specification

| Property | Data type | Format | Description |

|---|---|---|---|

| @id | string | Uri identifier of the current resource | |

| captureId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Identifier of the capture, must be unique for all types of captures within the ledger |

| authorizationId | number | Type: int64 | Identifier of the authorization, must be unique for all types of authorizations within the ledger |

| accountNo | string | The identifier of the account | |

| callbackUrl | string | If callback should be done on status change, it is done to the callback url. If empty no callback is done. | |

| sellerNo | string | The seller identifier at payex | |

| sellerReferenceId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Sellers reference id, usually the order id of the purchase / consistent for all captures/deliveries. |

| sellerTransactionId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | The sellers identifier of the capture/transaction, usually the receipt reference |

| authenticationMethod | string | Authentication method used to identify the user. Possible values 1FA (one factor),2FA (two factor) ,3FA (three factor) | |

| currency | string |

| |

| amount | number | Type: double Max: 100000000 Min: 0 | The amount of the authorization capture order, can't have more than 2 decimal places. |

| pointOfSale | string | Trade name of the point of sale. Will be displayed to end customer. Only use if agreed with provider of the API. | |

| status | string |

| |

| callbackBody | object | ||

| success | object | ||

| authorization | string | Uri to the created authorizarion. | |

| fail | dynamic | Problem definition of the authorization capture transaction. See problem section. | |

| operations | array | List of operations that is possible to perform on the current resource, read more about the hypermedia part of the response |

2. Authorizations

Get an existing authorization.

2.1 Get specific Authorization

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

Get authorization

Content-Type: application/json

{

"authorizationId": 456789,

"sellerNo": "654321",

"validToDate": "2023-03-01",

"authorizationAmount": 3600.00,

"remainingAmount": 3600.00,

"currency": "SEK",

"status": "Open",

"operations": [

{

"rel": "add-reversal",

"method": "POST",

"href": "/ledger/account-transaction/v1/xxx/authorizations/456789/reversals"

},

{

"rel": "add-capture",

"method": "POST",

"href": "/ledger/account-transaction/v1/xxx/authorizations/456789/captures"

},

{

"rel": "add-cancellation",

"method": "POST",

"href": "/ledger/account-transaction/v1/xxx/authorizations/456789/cancellations"

}

]

}

Possible problems

| Http status | Problem type | Description |

|---|---|---|

| 404 | not-found | Found no authorization for provided id on this ledger |

| 409 | invalid-account-usage | Provided PreAuthorization is invalid for this kind of authorization |

| 500 | fatal | Unexpected error, logs may give details about the problem |

Response object specification

| Property | Data type | Format | Description |

|---|---|---|---|

| @id | string | Uri identifier of the current resource | |

| authorizationId | number | Type: int64 | Identifier of the authorization, must be unique for all types of authorizations within the ledger |

| sellerNo | string | The seller identifier at payex | |

| validToDate | string | The authorization is valid for captures until this date. Format 'YYYY-MM-DD' | |

| authorizationAmount | number | Type: double Max: 100000000 Min: 0 | The original authorized amount |

| remainingAmount | number | Type: double | The remaining amount on the authorization available for capture |

| currency | string |

| |

| status | string |

| |

| operations | array | List of operations that is possible to perform on the current resource, read more about the hypermedia part of the response |

3. Reversals

3.1 Create Reversal

For reversing a specific capture

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

{

"reversalId": "654321",

"currency": "SEK",

"amount": 512.00,

"sellerTransactionId": "753159"

}

Request object specification

| Property | Data type | Format | Required | Description |

|---|---|---|---|---|

| reversalId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Yes | Identifier of the reversal, must be unique for all types of captures within the ledger |

| currency | string |

| Yes | |

| amount | number | Type: double Max: 100000000 Min: 0 | Yes | Amount to reverse |

| sellerTransactionId | string | Pattern: ^[a-zA-Z0-9#_:@.\-åäöÅÄÖ]{1,}$ | Yes | The sellers identifier of the reversal transaction, usually the receipt reference |

Content-Type: application/json

{

}

Possible problems

| Http status | Problem type | Description |

|---|---|---|

| 404 | not-found | Resource missing, may have been created on different ledger or have expired |

| 400 | validation | Validation error, response should describe the problem/s |

| 409 | currency-not-supported | Provided Currency does not match the authorization currency |

| 409 | invalid-amount | Provided Reversal Amount is invalid, likely larger than remaining captured amount |

| 409 | identifier-already-in-use | Provided Identifier is already in use, probably ReversalTransactionId is not unique |

| 409 | invalid-account-usage | Provided Authorization is invalid for this kind of reversal |

| 500 | fatal | Unexpected error, logs may give details about the problem |

Problems

All errors from the api are returned in the form of "problems" (response body), except for the http status code itself.

The problem object contain more detailed info on what the error is. The "type" property can be used to programmatically interpret the error as it contains a code definition of the problem.

Other properties can be useful for logging and subsequent troubleshooting. Some problems are extended with additional parameters so it may be a good idea to log response body as raw data to include these.

Problems of type validation does contain an additional list ("Problems") that describes exactly which parameter that failed the validation

Example

Content-Type: application/problem+json

{

"Type" : "ledger/{domain}/v1/problems/validation",

"Title" : "A validation error occurred",

"Status" : 400,

"Instance" : "215d4206-ca35-4f43-85ad-169c8f6d4ec1",

"Detail" : "A validation error occurred. Please fix the problems mentioned in the 'problems' property below.",

"Problems" :

{

"amount" : [

"Expected value between [0,01]-[79228162514264337593543950335] actual [0]"

]

}

}

1. Account-applications

Get an existing account-application. The account - application, is used when applying for new account.

1.1 Get specific Account-application

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

Content-Type: application/json

{

"redirectUrl": "https://ledger-apps.payex.com/ledger/public-account-transaction/v1/XXX/pre-authorization/8c535338-d92c-49e7-90bf-304dbf38e0bd",

"customer": {

"nationalConsumerIdentifier": {

"value": "19101010-1010",

"countryCode": "SE"

},

"email": "a@b.c",

"msisdn": "46123456",

"customerNo": "1234"

},

"profileName": "myProfileName",

"creditLimit": 5000.00,

"currency": "SEK",

"returnUrl": "https://webconsumerexample.se/consumerweb",

"redirectOptions": {

"nativeAppSwitchingUrl": "myApp",

"languageCode": "sv"

},

"operations": []

}

1.2 Create Account-application

Create account-application is used when applying for new account. the application process may include signing and credit check

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

{

"customer": {

"nationalConsumerIdentifier": {

"value": "19101010-1010",

"countryCode": "SE"

},

"email": "a@b.c",

"msisdn": "46123456",

"customerNo": "1234"

},

"profileName": "myProfileName",

"creditLimit": 5000.00,

"currency": "SEK",

"returnUrl": "https://webconsumerexample.se/consumerweb",

"redirectOptions": {

"nativeAppSwitchingUrl": "myApp",

"languageCode": "sv"

}

}

Request object specification

| Property | Data type | Format | Required | Description |

|---|---|---|---|---|

| customer | object | Yes | ||

| nationalConsumerIdentifier | object | Yes | ||

| value | string | Yes | The identifier - SSN, Personnummer, CPR, d-nummer, temporary identification number etc. Uniquely identifies the consumer. Visit developer.payex.com for information about supported national identifier format | |

| countryCode | string | Pattern: SE|NO|DK|FI | No | The country code for the identifier value property, value 'None' is not allowed, ISO 3166-1 alpha-2 |

| string | Pattern: [^@]+@[^\.]+\..+ | No | The customers Email. Only used for creating new customer | |

| msisdn | string | Pattern: [0-9, +, (, ), -]{5,15} | No | 'Mobile Subscriber Integrated Services Digital Network Number', ie. Cellphone number. Countrycode is always required as the example '46720000000'. Only used for creating new customer |

| customerNo | string | Pattern: ^[a-zA-Z0-9\-]{1,}$ | No | Provide the customer identifier. If customer does not yet exist in our ledger and ledger is configured to generate new customers CustomerNo then don't set this property. Ledger generated CustomerNo will be set after customer is created |

| profileName | string | Yes | The profilename of the account to create | |

| creditLimit | number | Type: double Max: 100000000 Min: 0 | Yes | The amount of the credit limit on the account applied for, can't have more than 2 decimal places |

| currency | string |

| Yes | |

| returnUrl | string | Yes | Url to return the end user to after process is completed | |

| redirectOptions | object | Yes | ||

| nativeAppSwitchingUrl | string | No | Uri pointing to app, used to switch back to app from bankId | |

| autostartAction | string | No | Used to automatically start bankId application. Possible actions (null|se-bankid-this-device) | |

| languageCode | string | Yes | Used to set desired language in the authenticate/onboarding web. Possible languageCodes (SV|EN) |

Content-Type: application/json

{

"redirectUrl": "https://ledger-apps.payex.com/ledger/public-account-transaction/v1/XXX/pre-authorization/8c535338-d92c-49e7-90bf-304dbf38e0bd",

"customer": {

"nationalConsumerIdentifier": {

"value": "19101010-1010",

"countryCode": "SE"

},

"email": "a@b.c",

"msisdn": "46123456",

"customerNo": "1234"

},

"profileName": "myProfileName",

"creditLimit": 5000.00,

"currency": "SEK",

"returnUrl": "https://webconsumerexample.se/consumerweb",

"redirectOptions": {

"nativeAppSwitchingUrl": "myApp",

"languageCode": "sv"

},

"operations": []

}

Possible problems

| Http status | Problem type | Description |

|---|---|---|

| 409 | account-already-exist | Occurs if a account already exists. |

Response object specification

| Property | Data type | Format | Description |

|---|---|---|---|

| @id | string | Uri identifier of the current resource | |

| customer | object | ||

| nationalConsumerIdentifier | object | ||

| value | string | The identifier - SSN, Personnummer, CPR, d-nummer, temporary identification number etc. Uniquely identifies the consumer. Visit developer.payex.com for information about supported national identifier format | |

| countryCode | string | Pattern: SE|NO|DK|FI | The country code for the identifier value property, value 'None' is not allowed, ISO 3166-1 alpha-2 |

| string | Pattern: [^@]+@[^\.]+\..+ | The customers Email. Only used for creating new customer | |

| msisdn | string | Pattern: [0-9, +, (, ), -]{5,15} | 'Mobile Subscriber Integrated Services Digital Network Number', ie. Cellphone number. Countrycode is always required as the example '46720000000'. Only used for creating new customer |

| customerNo | string | Pattern: ^[a-zA-Z0-9\-]{1,}$ | Provide the customer identifier. If customer does not yet exist in our ledger and ledger is configured to generate new customers CustomerNo then don't set this property. Ledger generated CustomerNo will be set after customer is created |

| profileName | string | The profilename of the account to create | |

| creditLimit | number | Type: double Max: 100000000 Min: 0 | The amount of the credit limit on the account applied for, can't have more than 2 decimal places |

| currency | string |

| |

| returnUrl | string | Url to return the end user to after process is completed | |

| redirectOptions | object | ||

| nativeAppSwitchingUrl | string | Uri pointing to app, used to switch back to app from bankId | |

| autostartAction | string | Used to automatically start bankId application. Possible actions (null|se-bankid-this-device) | |

| languageCode | string | Used to set desired language in the authenticate/onboarding web. Possible languageCodes (SV|EN) | |

| accountApplicationId | string | Unique identifier of the account-application. | |

| redirectUrl | string | Web uri pointing to the application flow that the user should be redirected to. | |

| operations | array | List of operations that is possible to perform on the current resource, read more about the hypermedia part of the response |

2. Limit-upgrade-applications

Get an existing limit-upgrade-application. The limit - upgrade - application, is used for upgrading limit on existing credit account.

2.1 Get specific Limit-upgrade-application

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

Content-Type: application/json

{

"redirectUrl": "https://ledger-apps.payex.com/ledger/public-account-transaction/v1/XXX/pre-authorization/8c535338-d92c-49e7-90bf-304dbf38e0bd",

"accountNo": "12345",

"customerNo": "54321",

"creditLimit": 5000.00,

"currency": "SEK",

"returnUrl": "https://webconsumerexample.se/consumerweb",

"redirectOptions": {

"nativeAppSwitchingUrl": "myApp",

"languageCode": "sv"

},

"operations": []

}

2.2 Create Limit-upgrade-application

Create limit-upgrade-application is used when applying for upgrading limit on existing credit account. The application process may include signing and credit check

Host: -

Authorization: Bearer<Token>

Content-Type: application/json

{

"accountNo": "12345",

"customerNo": "54321",

"creditLimit": 5000.00,

"currency": "SEK",

"returnUrl": "https://webconsumerexample.se/consumerweb",

"redirectOptions": {

"nativeAppSwitchingUrl": "myApp",

"languageCode": "sv"

}

}

Request object specification

| Property | Data type | Format | Required | Description |

|---|---|---|---|---|

| accountNo | string | Yes | The identifier of the account | |

| customerNo | string | Pattern: ^[a-zA-Z0-9\-]{1,}$ | Yes | The identifier of the customer. |

| creditLimit | number | Type: double Max: 100000000 Min: 0 | Yes | The amount of the credit limit on the account applied for, can't have more than 2 decimal places |

| currency | string |

| Yes | |

| returnUrl | string | Yes | Url to return the end user to after process is completed | |

| redirectOptions | object | Yes | ||

| nativeAppSwitchingUrl | string | No | Uri pointing to app, used to switch back to app from bankId | |

| autostartAction | string | No | Used to automatically start bankId application. Possible actions (null|se-bankid-this-device) | |

| languageCode | string | Yes | Used to set desired language in the authenticate/onboarding web. Possible languageCodes (SV|EN) |

Content-Type: application/json

{

"redirectUrl": "https://ledger-apps.payex.com/ledger/public-account-transaction/v1/XXX/pre-authorization/8c535338-d92c-49e7-90bf-304dbf38e0bd",

"accountNo": "12345",

"customerNo": "54321",

"creditLimit": 5000.00,

"currency": "SEK",

"returnUrl": "https://webconsumerexample.se/consumerweb",

"redirectOptions": {

"nativeAppSwitchingUrl": "myApp",

"languageCode": "sv"

},

"operations": []

}

Possible problems

| Http status | Problem type | Description |

|---|---|---|

| 404 | account-not-found | Occurs if the account is not found. |

Response object specification

| Property | Data type | Format | Description |

|---|---|---|---|

| @id | string | Uri identifier of the current resource | |

| accountNo | string | The identifier of the account | |

| customerNo | string | Pattern: ^[a-zA-Z0-9\-]{1,}$ | The identifier of the customer. |

| creditLimit | number | Type: double Max: 100000000 Min: 0 | The amount of the credit limit on the account applied for, can't have more than 2 decimal places |

| currency | string |

| |

| returnUrl | string | Url to return the end user to after process is completed | |

| redirectOptions | object | ||

| nativeAppSwitchingUrl | string | Uri pointing to app, used to switch back to app from bankId | |

| autostartAction | string | Used to automatically start bankId application. Possible actions (null|se-bankid-this-device) | |

| languageCode | string | Used to set desired language in the authenticate/onboarding web. Possible languageCodes (SV|EN) | |

| limitUpgradeApplicationId | string | Unique identifier of the account-application. | |

| redirectUrl | string | Web uri pointing to the application flow that the user should be redirected to. | |

| operations | array | List of operations that is possible to perform on the current resource, read more about the hypermedia part of the response |

Problems

All errors from the api are returned in the form of "problems" (response body), except for the http status code itself.

The problem object contain more detailed info on what the error is. The "type" property can be used to programmatically interpret the error as it contains a code definition of the problem.

Other properties can be useful for logging and subsequent troubleshooting. Some problems are extended with additional parameters so it may be a good idea to log response body as raw data to include these.

Problems of type validation does contain an additional list ("Problems") that describes exactly which parameter that failed the validation

Example

Content-Type: application/problem+json

{

"Type" : "ledger/{domain}/v1/problems/validation",

"Title" : "A validation error occurred",

"Status" : 400,

"Instance" : "215d4206-ca35-4f43-85ad-169c8f6d4ec1",

"Detail" : "A validation error occurred. Please fix the problems mentioned in the 'problems' property below.",

"Problems" :

{

"amount" : [

"Expected value between [0,01]-[79228162514264337593543950335] actual [0]"

]

}

}